Welcome to the Rekt Capital newsletter, a resource for people who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

I write research articles just like this one every Monday and Wednesday for subscribers of the Rekt Capital newsletter. Friday’s feature my thoughts, charts, and analysis on a wide-variety of Altcoins.

Today’s edition is free for everybody to read. Last full free edition was posted on Feb’ 28th.

If you’d like to receive cutting-edge research like this straight to your inbox - feel free to subscribe for $14 a month:

In today’s newsletter we’ll focus on a) the levels that enable a Bullish case for Bitcoin’s price action and b) the scenario for a Bearish case.

Also coming up this week is Part 2 to the “Is It The Right Time To Buy Altcoins?”.

And sometime next week, I will share my contingency plan should the Bullish case fail for Bitcoin.

Let’s dive in.

Bitcoin - Bulls’ Last Stand

Bitcoin - Macro Higher Low Is Lost

Bitcoin has occupied this $28000-$69000 Macro Range for months - this is clear to us.

But recently, Bitcoin broke down from two trendlines:

Macro Higher Low (black)

Which was a multi-month Higher Low dating back to mid-2021. It highlighted the shifting psychology in premium-buying on the side of the buyers.

This Higher Low was a great testament to building bullish momentum. However, this psychology has since lapsed as the Higher Low was lost.

Blue Higher Low

This HL connected the downside wicks dating back to mid-2021. This trendline denoted the outlier psychology in premium-buying behaviour on the side of the buyers.

The fact that both Higher Lows have been lost indicates an invalidation of bullish momentum.

Bitcoin - Macro Range Still Intact

That being said, the loss of the trendlines don’t change anything when it comes to the macro consolidation between $28000-$69000.

It just means that the potential bullish momentum needed for a reversal to reach levels higher inside the range has been lost.

By the same token, this in turn suggests that price will try to find support inside the green Macro Range Low area.

This is ultimately the region that needs to hold for Bitcoin to have a chance at this current range being one of Re-Accumulation rather than Distribution.

Yes, Bitcoin has reversed from here before in early 2021 and mid-2021.

But…

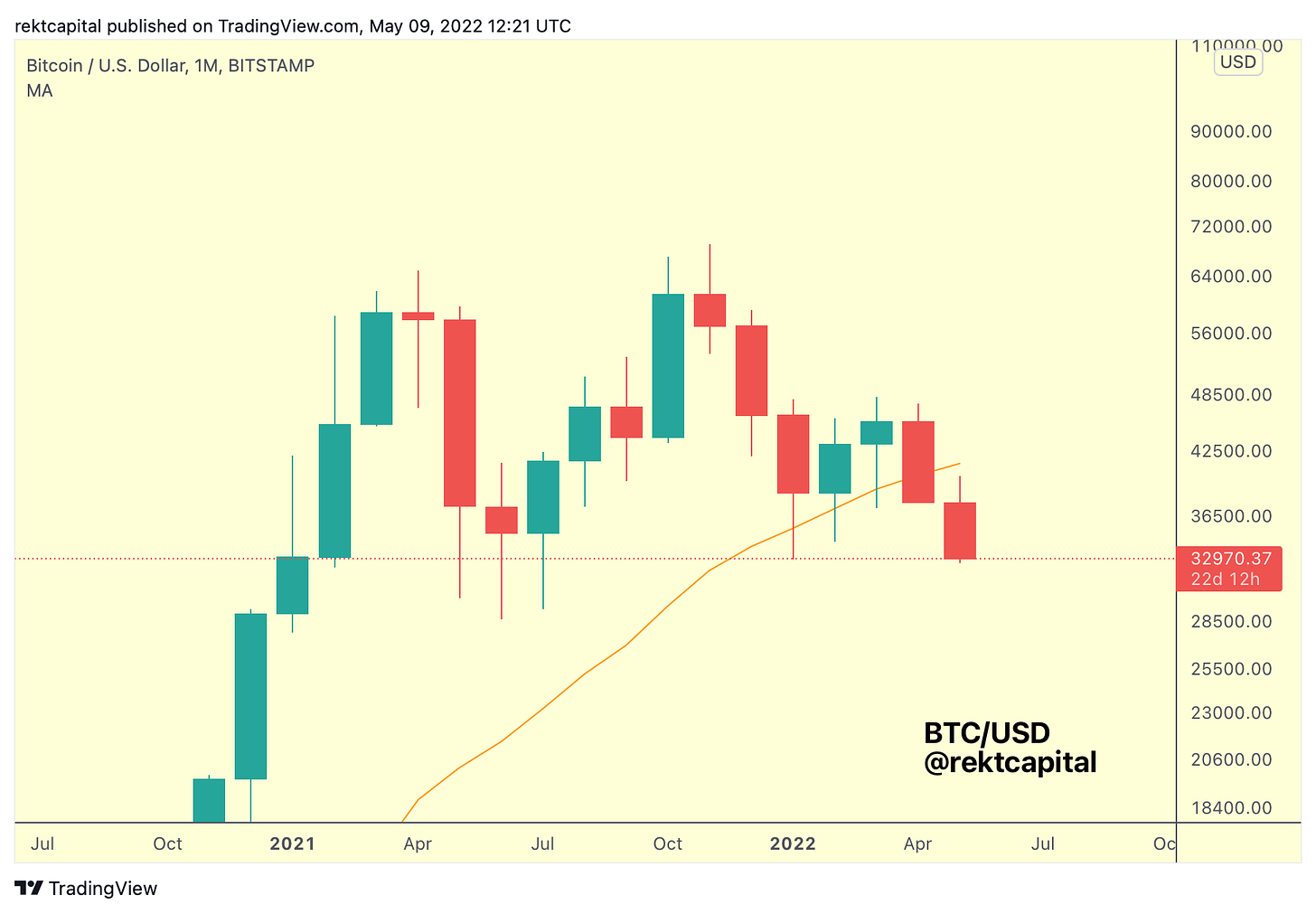

If Bitcoin isn’t able to Monthly Close above the blue $35000 Monthly level, that will confirm a weakness in buy-side interest in the green area.

Remember, in mid-2021, Bitcoin had produced three consecutive downside wicks into the green Macro Range Low before reversing.

This was a visual testament towards the strength on the side of buyers residing inside this region.

But if BTC Monthly Closes below inside the green area - it will be clear that the weakness in the area is appearing on the buy-side.

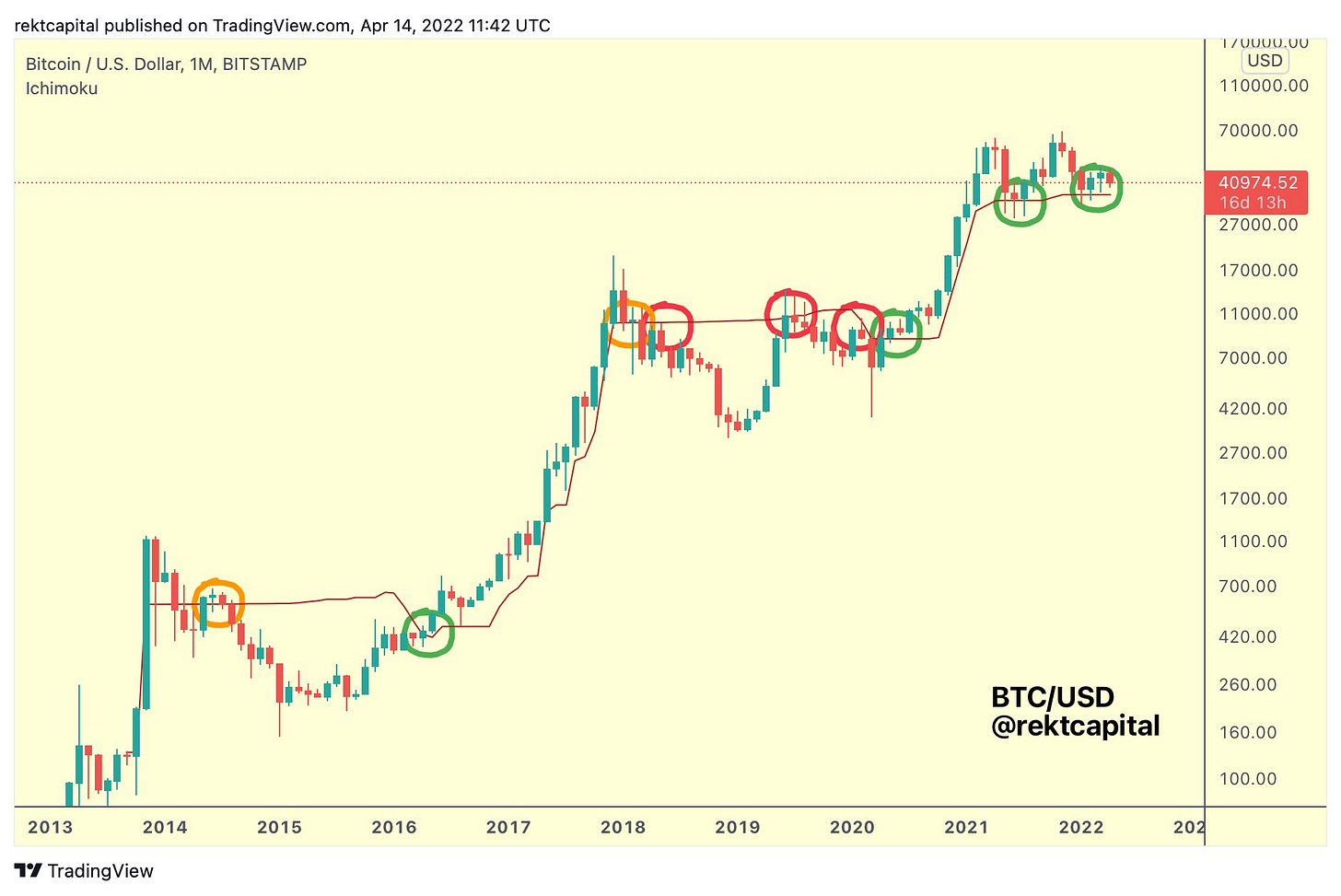

Notice also how this Monthly level is a confluent level of support with the Monthly Kijun-sen of the Ichimoku Cloud:

We know that a Monthly Close below $35000 may not be very good for Bitcoin, but a Monthly Close below the Kijun (which is exactly the same level) shows that that could be confirmation for a Bear Trend:

After all, losing the Kijun as support has preceded extended Bear Trends before, especially if this Kijun is flipped into new resistance upon a relief rally.

Which leads to the next point…

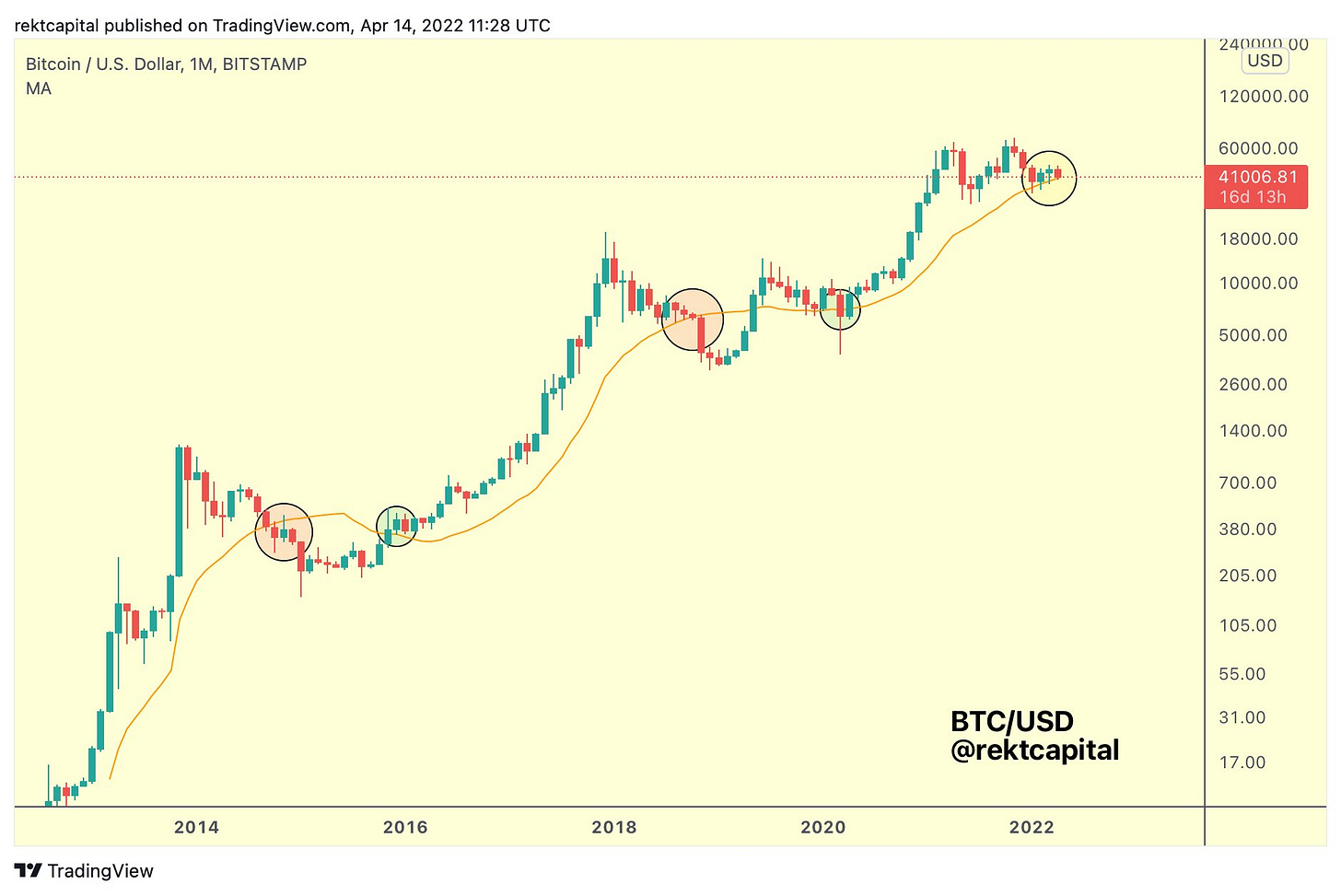

20 Month MA Signalling Bear Trend?

Just like the Monthly Kijun, the 20-Month MA is a good reference for Bull and Bear Trends.

However, Bitcoin has lost this level as well:

It’s clear BTC needs to reclaim the orange MA or price could experience further downside.

How much downside?

Historically, losing the 20-Month as support has preceded a further -46% to -63% drop in price. It takes months for price to finally capitulate via a long downside wick before forming a multi-month accumulation range at generational lows, which ultimately precedes a new Bull Trend.

Right now, BTC is down -21% from the 20-Month MA.

Of course, as long as BTC holds its Macro Range Low support area, BTC won’t see more downside. As we can see, Bitcoin is at its Range Low area (green) which rests just below the 20-Month MA.

So should BTC rebound from here, it’s crucial that BTC reclaims the orange 20-Month MA as support, otherwise that rebound will have just been a move of relief which would be evidence of weakness in the green area.

The green area is the Bull’s last stand.

Thank you for reading this free edition of the Rekt Capital newsletter.

If you enjoyed this edition - I guarantee you’ll love the Rekt Capital newsletter. Feel free to Subscribe today for only $14 a month: