Welcome to the Rekt Capital newsletter, a resource for people who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

I write research articles just like this one every Monday for subscribers of the Rekt Capital newsletter.

Today’s edition is Part 2 of the Stock to Flow series and is free to everybody to read.

In case you missed it, check out Part 1 here. And if you’d like to learn even more, feel free to check out Part 3.

And if you’d like to receive cutting-edge research like this straight to your inbox during this Crypto Bull Market - feel free to subscribe for $14 a month:

Part 2

Preface

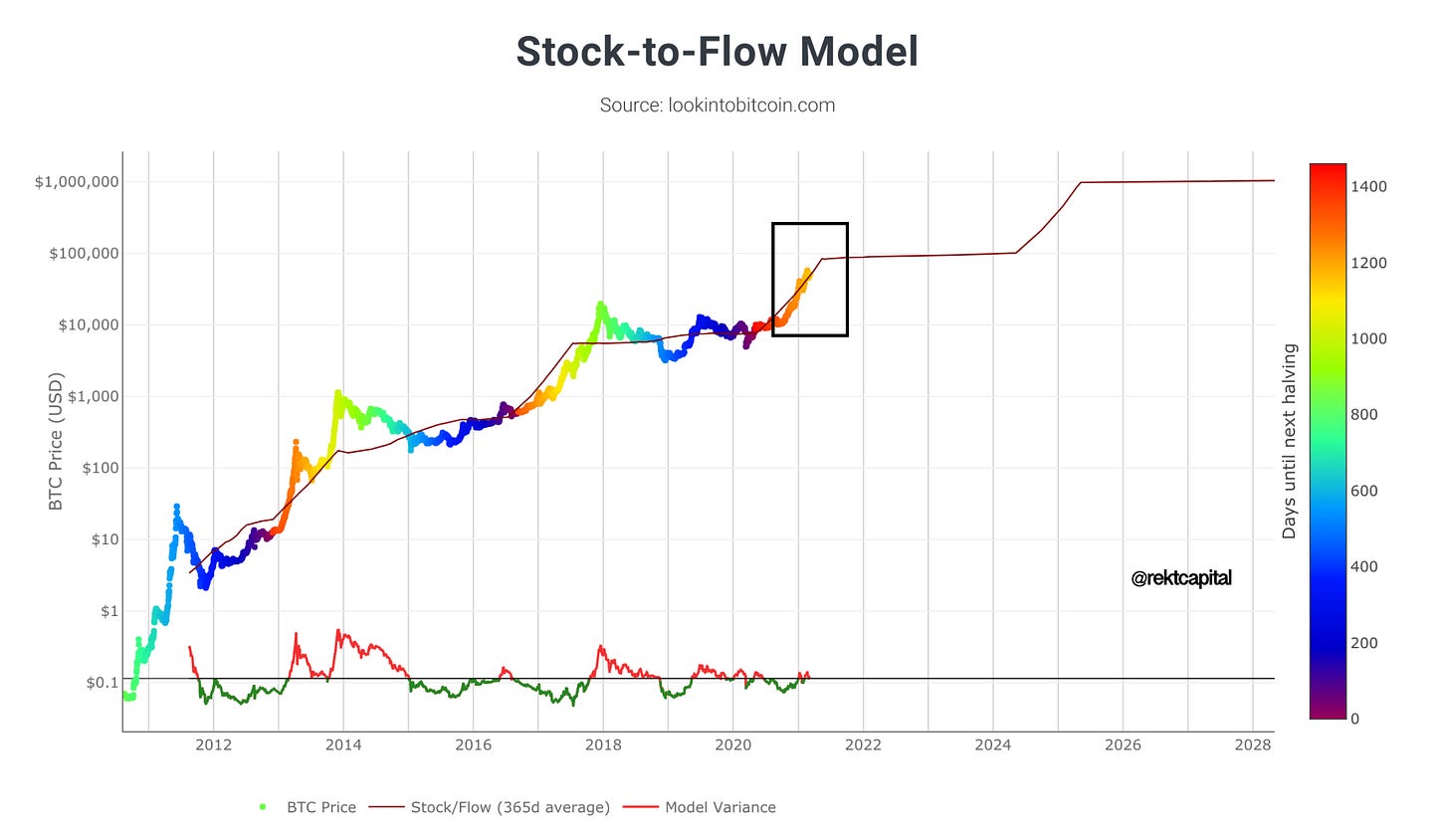

The Stock to Flow model created by Plan B quantifies the scarcity of Bitcoin and has been a reliable long-standing predictor of Bitcoin’s price trajectory.

After all - Bitcoin’s price action has been following the Stock to Flow model, sometimes even exactly tracing it for extended periods of time.

This is why the Stock to Flow figures as a useful data science model for investors to fall back on during periods of volatility and uncertainty in the cryptocurrency market.

But the usefulness of the model doesn’t end there.

Bitcoin’s price also tends to consistently deviate beyond and below the Stock to Flow line.

Historically, Bitcoin’s price deviations from the Stock to Flow line - whether to the upside or to the downside - have preceded Bear Market bottoms and Bull Market tops in Bitcoin’s price.

In Part 1 of the Stock to Flow series, we examined the first three upside deviations in Bitcoin’s price beyond the Stock to Flow model:

The first upside deviation beyond the Stock to Flow line resulted in a +1157% Bitcoin price increase.

The second upside deviation beyond the Stock to Flow line resulted in a +477% price increase.

And the third upside deviation culminated in a +554% increase in Bitcoin’s price.

This is Part 2 of the Stock to Flow series where we will focus specifically on the remaining three Bitcoin upside price deviations from the Stock to Flow line (i.e. 4, 5, and 6).

Part 3 will exclusively address the sixth upside deviation from the Stock to Flow line in much more detail in an effort to deduce when and where the upcoming Bitcoin price peak may take place.

4. Fourth Stock to Flow Upside Deviation

Bitcoin Bull Market Peak (December 2017)

Let’s focus on the fourth instance where Bitcoin’s price deviated towards the upside, beyond the Stock-to-Flow line.

This upside deviation from the Stock To Flow line in occurred during the mid-December 2017 Bitcoin Bull Market peak.

The deviation began by breaking past the Stock to Flow line in mid-October 2017, when Bitcoin’s price was at approximately $5,500:

After breaking the Stock to Flow line, Bitcoin’s price rallied exponentially to a peak of $19,640 in mid-December 2017:

Over the span of only two months, Bitcoin’s price deviated +257% beyond the Stock to Flow line:

5. Fifth Stock to Flow Upside Deviation

Bitcoin Peak (June 2019)

Here’s the fifth time that Bitcoin’s price deviated to the upside, beyond the Stock-to-Flow line.

This upside deviation from the Stock To Flow line peaked in June 2019.

The deviation began by breaking past the Stock to Flow line in mid-May 2019, when Bitcoin’s price was at approximately $7,300:

Just over one month later, Bitcoin peaked at ~$12,900 ($13,900 according to most exchanges):

At this point, Bitcoin’s price deviated +76% beyond the Stock to Flow line (or +90% to reach $13,900):

Across all upside deviations in Bitcoin’s price beyond the Stock to Flow line, this one in particular was the weakest.

But in order to understand this upside deviation, we have to revert to the first principles of the Stock to Flow model and what the model represents.

To reiterate, the Stock to Flow model quantifies the scarcity of Bitcoin.

And the Bitcoin Halving event promotes this scarcity.

And since scarcity enhances value - Bitcoin’s price appreciates significantly in the several months after the Halving.

But what we need to emphasise when considering this particular upside deviation in Bitcoin’s price beyond the Stock to Flow model is that it occurred almost a year prior to Bitcoin Halving #3.

Nothing had fundamentally changed in Bitcoin’s protocol at that point and therefore - neither did Bitcoin’s Stock to Flow.

After all - whenever a Halving event occurs, the amount of Bitcoin that gets created every 10 minutes is suddenly cut in half, directly impacting the scarcity of the asset. This scarcity is visualised by the Stock to Flow model.

So while Bitcoin’s exponential growth to ~$20,000 in December 2017 was propelled by the major fundamental catalyst that was Bitcoin Halving #2…

This June 2019 upside price deviation beyond the Stock to Flow line - which occurred a year before Bitcoin Halving #3 - was actually not caused by an increasing scarcity in Bitcoin.

In other words, nothing had changed in Bitcoin’s Stock to Flow at that point.

In fact, Bitcoin’s Pre-Halving #3 uptrend from ~$3,150 to $13,900 was historically normal pre-Halving price behaviour.

After all, Bitcoin rallied +663% prior to Halving #1:

Bitcoin rallied +383% prior to Halving #2:

And Bitcoin rallied +343% prior to Halving #3:

So while Bitcoin’s Pre-Halving #3 uptrend from ~$3,150 to $13,900 was historically normal pre-Halving price behaviour…

Bitcoin’s price just happened to deviate beyond the Stock to Flow line during that period.

Through the lens of the Stock to Flow model, this upside deviation in Bitcoin’s price was just Bitcoin’s way of simply trend-following the Stock to Flow line, as Bitcoin tends to do throughout it’s price history.

The key takeaway here is that it’s not just about mere upside deviations in Bitcoin’s price beyond the Stock to Flow line viewed in a vacuum…

It’s about the upside deviations that occur after the Halving event where the actual Stock to Flow of Bitcoin has been altered and in turn where most of the explosive growth in Bitcoin’s price occurs later in the Market Cycle.

Most of the exponential growth in Bitcoin’s price occurs several months after the Halving.

And the sixth Stock to Flow upside deviation that we’ll now cover is yet another testament to that.

6. Sixth Stock to Flow Upside Deviation

Bitcoin Bull Market Peak (To Be Decided…)

Here’s the sixth time that Bitcoin’s price deviated to the upside, beyond the Stock-to-Flow line.

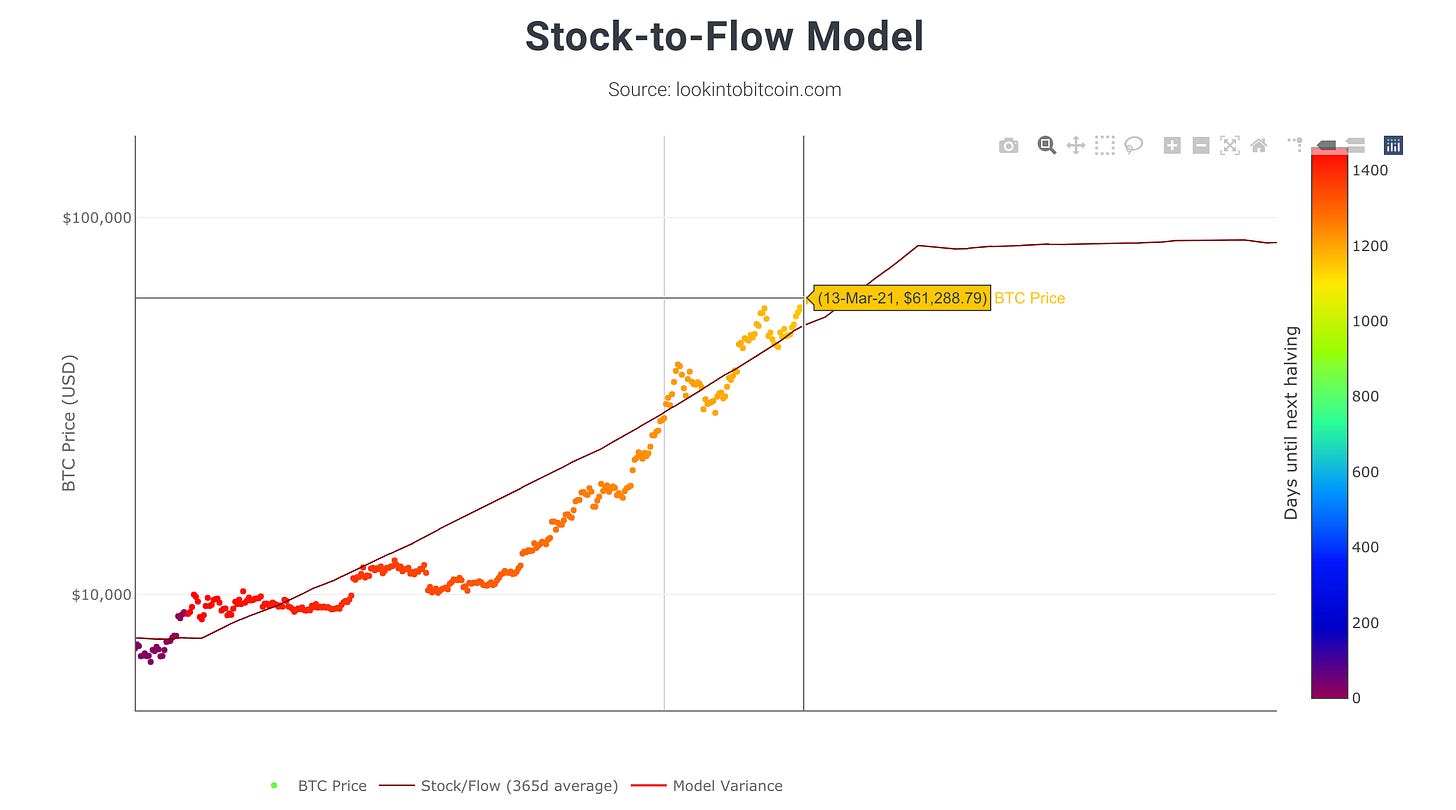

As of this writing, Bitcoin’s price has only just reached a new All Time High of ~$61,000.

But here’s the problem - Bitcoin’s price has not yet clearly deviated from the Stock to Flow line:

In fact, Bitcoin’s price is merely meandering along the Stock to Flow line.

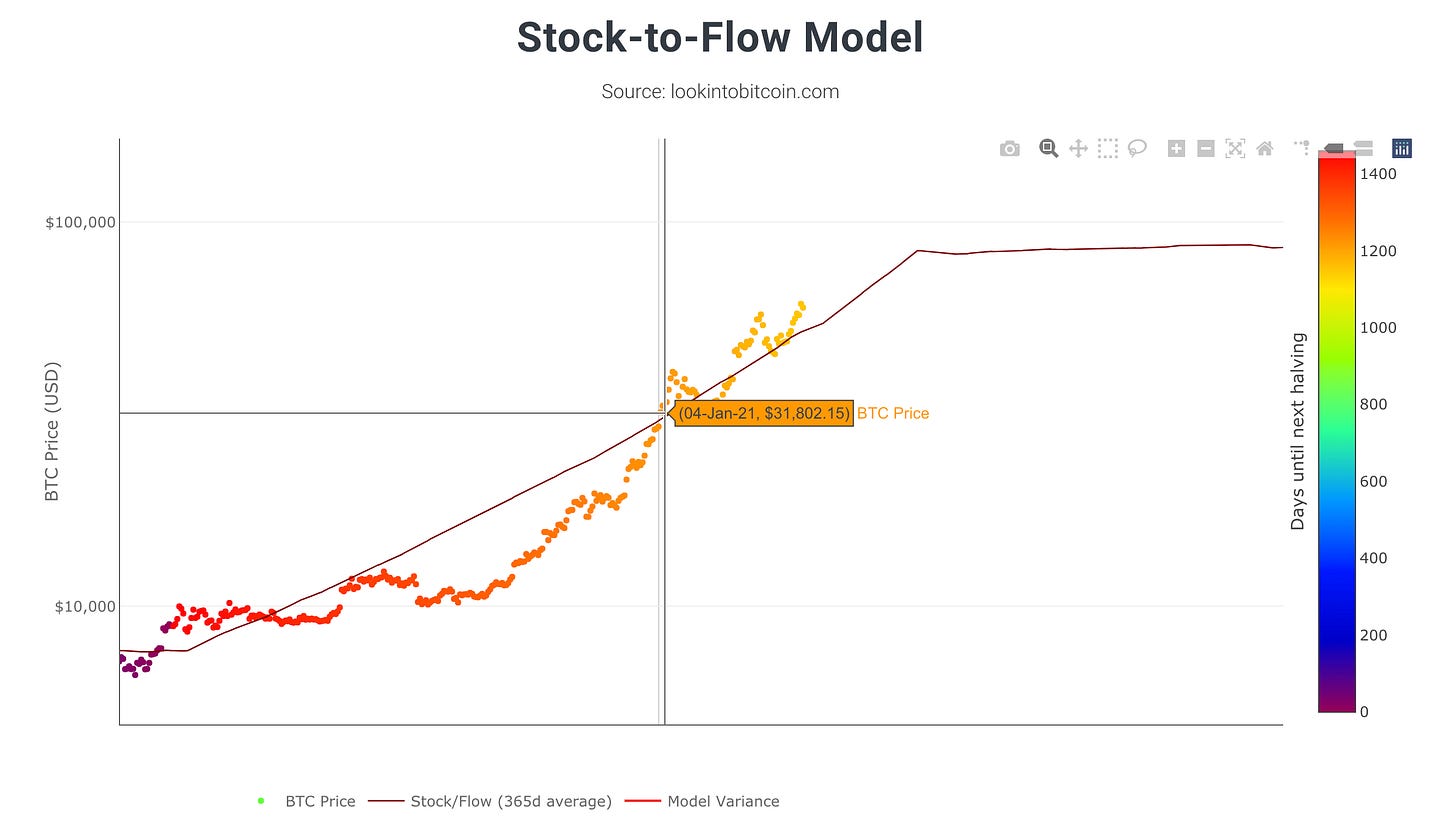

In early January 2021, Bitcoin briefly broke beyond the Stock to Flow line which was at a price point of ~$31,800:

Shortly afterwards however, Bitcoin dipped below the Stock to Flow line before once again pulling up beyond it - but this time the Stock to Flow line was at a price point of ~$39,300:

After that brief upside deviation however, Bitcoin’s price dipped once again but this time it actually treated the Stock to Flow line as a support at the price point of ~$45,300 before spring-boarding back up:

What should we make of this?

Most importantly - no clear upside deviation in Bitcoin’s price action beyond the Stock to Flow line has yet occurred.

This means a few crucial things:

Bitcoin’s price is still trend-following the Stock to Flow line

As mentioned throughout the series, Bitcoin either deviates beyond or below the Stock to Flow line - or it just simply follows the Stock to Flow line, sometimes even perfectly tracing it.

Bitcoin is currently still in the phase of its Bull Market where it simply follows the Stock to Flow line.

But why is Bitcoin’s price trend-following the Stock to Flow line if Bitcoin’s price has been consistently increasing for the past several months?

Because the Stock to Flow line is also increasing.

The Stock to Flow model is still actively adjusting to Bitcoin’s newfound scarcity caused by the third Bitcoin Halving that took place in May 2020.

The Stock to Flow line is still adjusting - and so is Bitcoin’s price.

Which leads me to the next crucial insight:

Bitcoin is still early in its current Market Cycle

The Stock to Flow has proven itself to be a reliable predictor for Bitcoin’s future price trajectory.

It’s almost as if the Stock to Flow is outlining the path for Bitcoin’s future price trajectory.

In fact, there has never been a time in Bitcoin’s history where Bitcoin’s price would so closely follow the ascending Stock to Flow line - except for now:

Generally, Bitcoin reaches the most euphoric portions of its Bull Market when it transitions away from following the Stock to Flow line and begins to actually deviate beyond it.

This is when Bitcoin’s price becomes its most volatile but also appreciates at a rapid rate to reach euphoric new All Time Highs.

The fact that Bitcoin’s price is still just following the Stock to Flow line means that Bitcoin hasn’t yet reached the final, most euphoric phase of its Bull Market.

When Bitcoin’s price finally deviates from the Stock to Flow line, Bitcoin’s price will experience significant price expansion and rapidly accelerate in its uptrend.

This is the period where the most exponential price increases occur.

That being said, Bitcoin’s price hasn’t deviated beyond the Stock to Flow line - yet.

Which leads us to the most important two questions:

When could Bitcoin’s price deviate beyond the Stock to Flow line?

And where could Bitcoin’s price deviate towards?

Closing Thoughts

This was Part 2 of the Stock to Flow series where we discussed the remaining three major upside Bitcoin price deviations from the Stock to Flow line:

In Part 3 of this Stock to Flow series, we’ll specifically cover the sixth upside deviation from the Stock to Flow line in an effort to deduce when and where the upcoming Bitcoin price peak may take place.

Feel free to Subscribe to the Rekt Capital newsletter for $14 a month:

Thanks for reading this free edition of the Rekt Capital newsletter.

Hopefully this special edition gave you a powerful idea as to the level of quality, detail, and dedication that you can expect as a valued subscriber of the Rekt Capital newsletter.

I write research articles like this every Monday for subscribers of the newsletter.

So if you’d like to receive cutting-edge research like this straight to your inbox, feel free to subscribe for $14 a month:

Good analysis as always. Thank you! Have you noticed that the price and S2F lines in the live charts by LookingIntoBitcoin (which you cited) and digitalik.net seem to be slightly different, with the price in the digitalik.net chart deviating more from S2F. I have not looked into the equations used to plot the S2F trend lines in these two charts yet. Just wondering if it was something factored differently in the model construction.

You bring brilliant informative stuff. You make us see the bigger picture and keep us level headed. I can't wait for the new course to come out, isn't that going to happen this week ? Or do I have to DM you for that ? ;) I already bought the other two courses and learned so much. It gives you a good understanding and must have knowledge to participate in this market space.