Welcome to the Rekt Capital newsletter, a resource for people who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

I write research articles just like this one every Monday and Wednesdays for subscribers of the Rekt Capital newsletter.

Today’s edition is free for everybody to read.

If you’d like to receive cutting-edge research like this straight to your inbox during this Crypto Bull Market - feel free to subscribe for $10 a month:

Introduction

Bitcoin is on the cusp of a potential Death Cross.

Whenever a Death Cross occurs, BTC experiences deeper downside.

How likely is it that this Death Cross occurs for Bitcoin?

And if it does - what should we potentially expect?

Here's a newsletter with my thoughts about the Death Cross.

Golden Cross vs Death Cross

A bullish Golden Cross occurs when the 50 EMA (blue) crosses OVER the 200 EMA (black).

Golden Crosses precede lots of upside in BTC's price (green).

A bearish Death Cross occurs when the 50 EMA crosses UNDER the 200 EMA (red).

Death Crosses precede lots of downside for BTC.

Let’s now take a look at Bitcoin’s Death Crosses across its Bull Markets.

November 2013 Death Cross

But notice how it takes a significant amount of time for Bitcoin to actually perform a bearish Death Cross (red).

When BTC peaked in 2013, it took 135 days for the Death Cross to occur. That's over 4 months And during those 4+ months...

Bitcoin dropped -73%.

The Death Cross occurs with some lag.

So by the time it happens - a lot of downside will have already happened.

That said, the Death Cross confirms a bearish trend and precedes even more downside.

And in 2013, the Death Cross preceded an additional -71% drop...

December 2017 Death Cross

Let's take another period into account:

When Bitcoin peaked in 2017, it took 107 days for the Death Cross to occur.

That's 3.5 months.

And during those 3+ months...

Bitcoin dropped -70% from the $20,000 peak.

Yes, Bitcoin dropped -70% before the Death Cross actually occurred.

But once the Death Cross happened…

Bitcoin experienced an additional -65% correction to the downside.

The Death Cross once again confirmed even more downside.

June 2019 Death Cross

Let's now take a look at another historical Death Cross period:

When Bitcoin peaked in June 2019, it took 149 days for the Death Cross to occur.

It took BTC 5 months to perform a Death Cross.

But until that Death Cross occurred, Bitcoin’s price had already dropped by -53%.

But once the Death Cross took place, Bitcoin dropped an additional -55% to the downside:

2021 Bitcoin Death Cross Coming Soon?

Bitcoin is potentially on the cusp of a new Death Cross soon.

Let's assume it happens (though it doesn't necessarily have to).

We need to now address two questions:

When could this Death Cross happen?

How much extra downside could Bitcoin see after it happens?

“When?”

First let's address the question of "when."

Historically, Bitcoin tends to perform a Death Cross between 107 to 149 days:

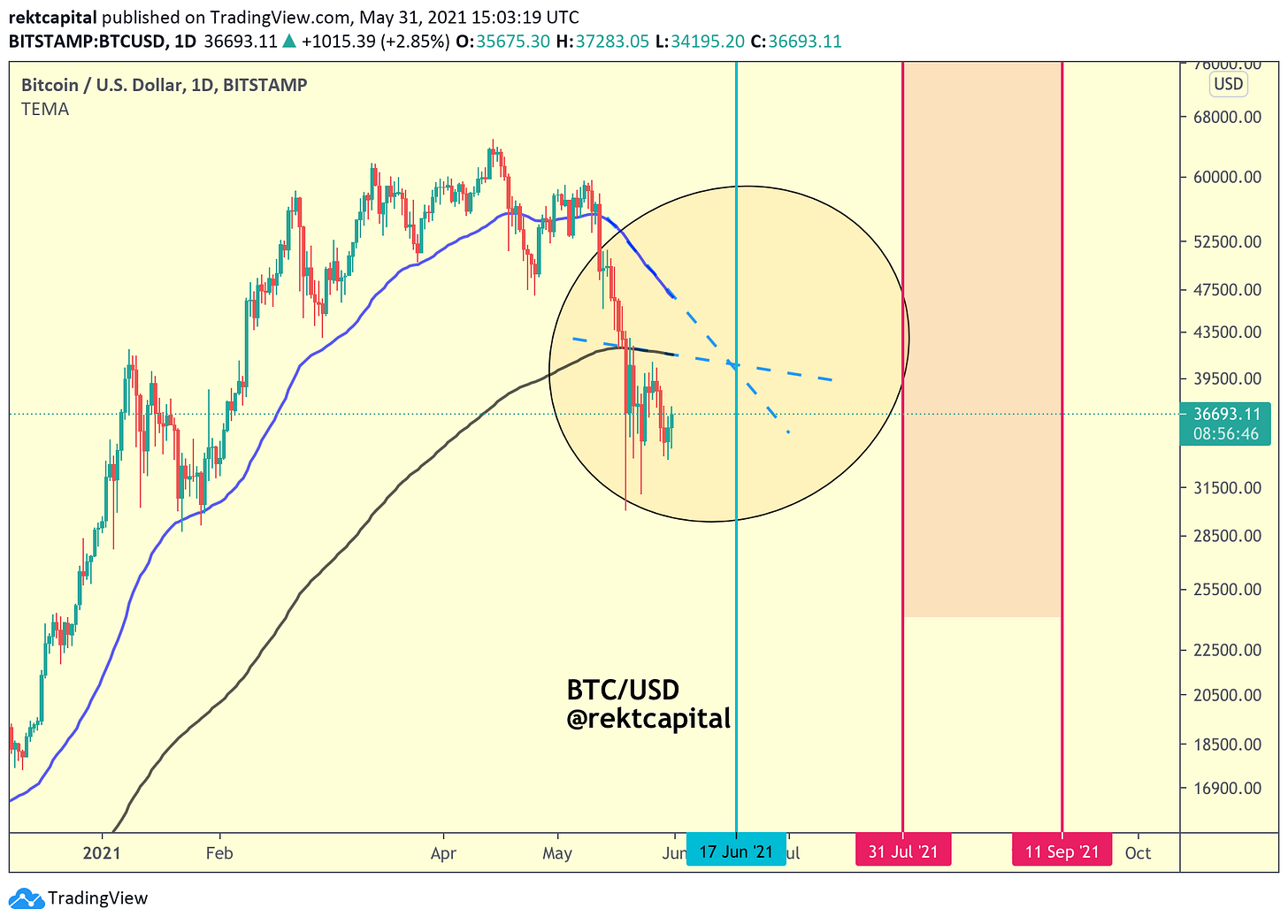

If history repeats, Bitcoin could see its Death Cross occur sometime between very late July or in early September 2021 (red area).

Right now, the 50 EMA (blue) and 200 EMA (black) are converging rapidly towards one another:

If Bitcoin doesn't increase in its price soon and the EMAs continue at the same current pace...

The Death Cross could happen sooner in mid-June 2021 (blue).

How Much Could Bitcoin Retrace Upon A New Death Cross?

Now let's address the question of "how deep could Bitcoin retrace upon Death Cross?"

So far, Bitcoin has crashed -54% since its ~$65K highs.

And before we answer the question of how much downside could happen upon the Death Cross, let's recall the symmetry in past Death Crosses:

“The depth of a BTC correction pre-Death Cross is similar to retrace depth post-Death Cross”

In 2013, Bitcoin dropped -73% pre-Death Cross and dropped an extra -70% post-Death Cross.

In 2017, Bitcoin dropped -70% pre-Death Cross and dropped an extra -65% post-Death Cross.

In 2019, Bitcoin dropped -53% pre-Death Cross and dropped an extra -55% post-Death Cross.

So since Bitcoin has crashed -54% already and should this symmetry hold, BTC could crash an extra -54% if a Death Cross happened today.

This would result in a ~$18,000 Bitcoin.

This sort of symmetry would be in line with history as Bitcoin crashed an extra -55% post-Death Cross after the June 2019 peak.

But if history were to repeat itself with a -65% or -71% crash...

That would result in a $14000 and $11500 Bitcoin which both seem very unlikely.

The 200-Week EMA Tends To Figure As The Point Of Maximum Financial Opportunity

What's interesting about the scenario of a -55% post-Death Cross crash however is that it would result in a $18000 BTC.

Which ties in with the 200-Week EMA (black) which tends to offer fantastic opportunities with outsized ROI for Bitcoin investors (green boxes highlight this):

A -55% crash towards the 200-Week EMA would only be possible if the 50-Week EMA is lost as support and a Death Cross occurs soon.

Thank you for reading.

Thank you for reading this free edition of the Rekt Capital newsletter.

Hopefully this special edition gave you a powerful idea as to the level of quality, detail, and dedication that you can expect as a valued subscriber of the Rekt Capital newsletter.

I write research articles like this every Monday and Wednesday for subscribers of the newsletter.

So if you’d like to receive cutting-edge research like this straight to your inbox, feel free to subscribe for $10 a month: